What Affects Your Credit Score

April 29, 2022

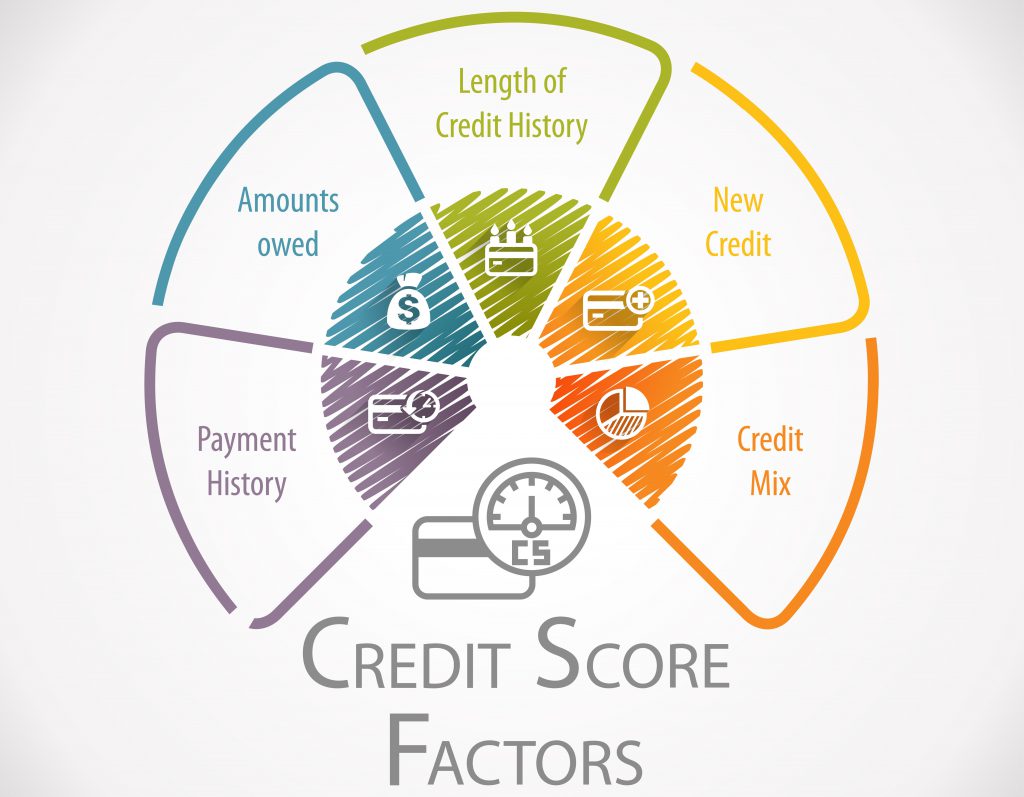

Here, we discuss credit history length, credit mix, and new credit credit.

If you have been following along, you know that we’ve been discussing the five factors that affect your credit score:

- Payment History

- Amounts Owed

- Credit History Length

- Credit Mix

- New Credit

Last month we focused on payment history and the importance of making your payments on time. Now, we want to focus on the last three areas; Credit History Length, Credit Mix, and New Credit.

Credit History Length

Credit History Length is exactly what you think it is; how long have you had accounts on your credit report? The sooner a person can open a credit card after their 18th birthday the better. This gets things started, but the thing to keep in mind is to not close that account. Many people will close old credit cards and charge card accounts that they don’t use anymore. While this can help prevent fraud, it can hurt your credit if you have had those cards for a long time, and if you remember from a previous blog, closing those cards will decrease the amount of revolving credit you have and hurt your credit utilization ratio. So before you close those cards, take a look and see how long you have had it. On the flip side if you have a bunch of new accounts on your credit this could hurt you. If you’ve opened several new accounts in the last year, this can send the wrong message that you are overextended and living above your means. If you feel like this is a balancing act, you’re right, because it most certainly is.

Credit Mix

Credit Mix is what different types of accounts are on your credit report. It’s important to have a good mix of revolving credit, like credit cards, as well as installment loans, like auto loans, mortgages, and personal loans.

New Credit

New Credit is what it sounds like as well, how many new accounts do you have? We have seen people lose between three and seven points every time someone pulls their credit. We have also seen people lose up to 10 points for every new account they open. So if you are shopping for a new car, you don’t want every car dealership pulling your credit because you will lose on average five points each time. Then, when you do decide on a car and get a loan for it, you can lose, on average, an additional 10 points when the new car loan hits your credit. Knowing what will affect your credit and by how much can be a bit confusing and hard to keep track of, but we’re here to help! We realize we all typically have to get a loan at some point in time, but if you can only have your credit pulled when necessary, you will limit the number of points you are losing.

Grove City Area Federal Credit Union’s Mission

Our mission is to get your score above 720 and help you keep it there. Stop in to see one of our professionals today so we can review your individual credit report and share specific tips to get your credit score where you deserve it to be. With a stronger credit score, you’ll qualify for better rates that could save you money.

Here at Grove City Area Federal Credit Union, we are Banking but Better.